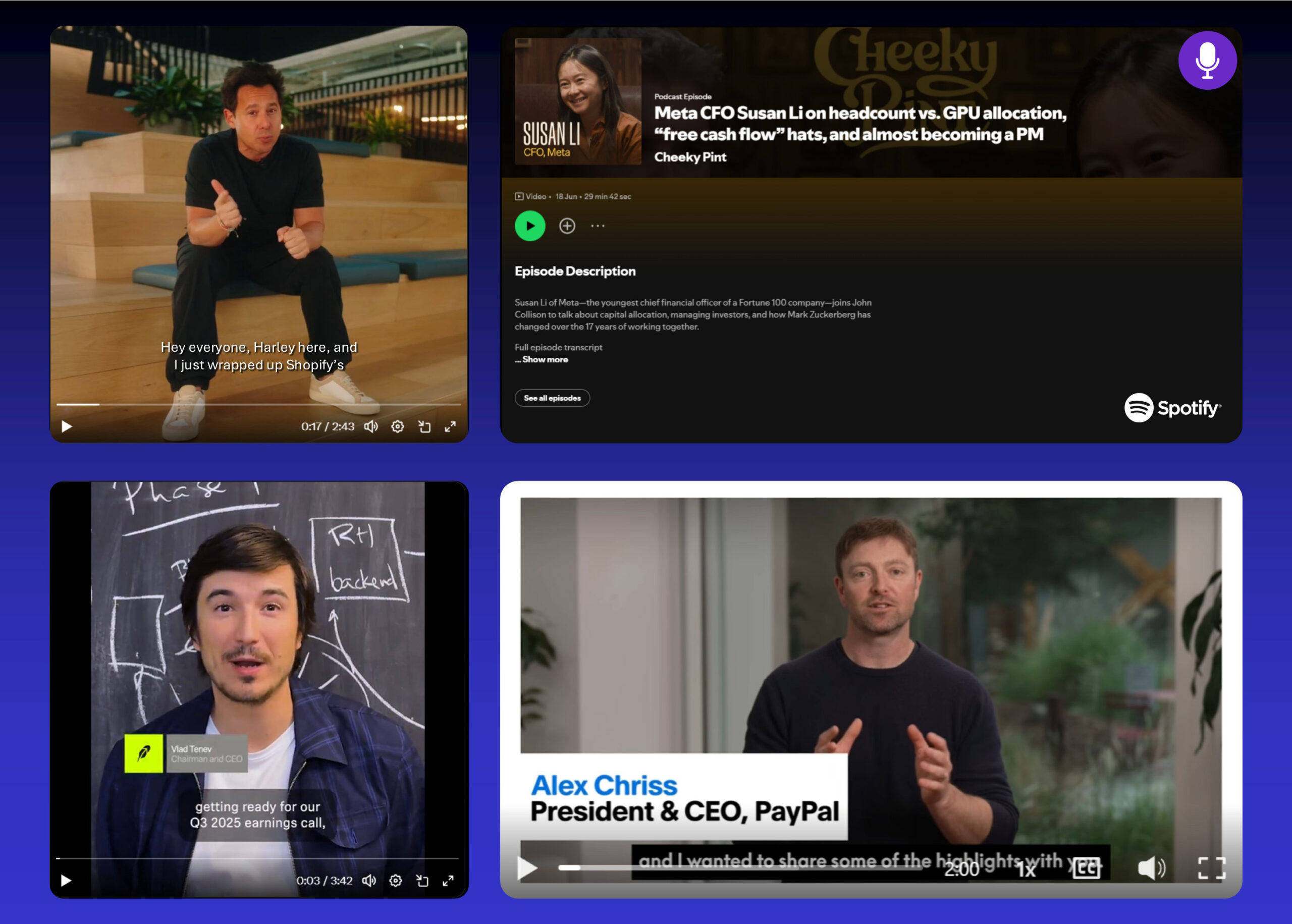

Best of Q3 ’25 Earnings: How IROs Are Amplifying Their Story Beyond the Call

How does your Presentation measure up?

Do you have a major event or a high-stakes meeting coming up? Do you need a sharp narrative and bold design?

Let's connect and we can take a closer look at your presentations. We'll share with you actionable ideas along with real examples that you can apply to improve odds of success.